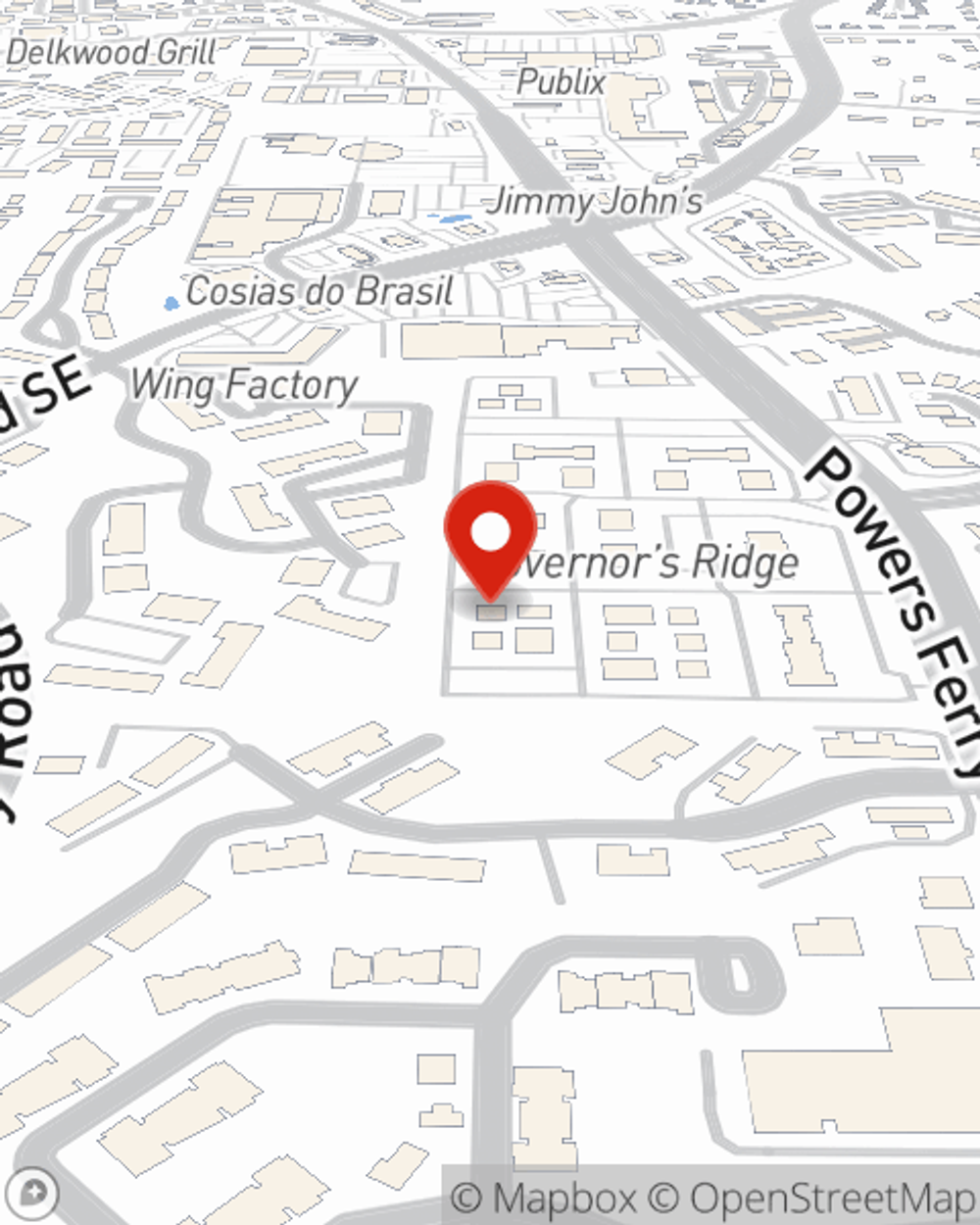

Business Insurance in and around MARIETTA

One of the top small business insurance companies in MARIETTA, and beyond.

Helping insure businesses can be the neighborly thing to do

State Farm Understands Small Businesses.

When you're a business owner, there's so much to keep track of. We get it. State Farm agent Janis Mosley is a business owner, too. Let Janis Mosley help you make sure that your business is properly insured. You won't regret it!

One of the top small business insurance companies in MARIETTA, and beyond.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your income, but also helps with regular payroll overhead. You can also include liability, which is crucial coverage protecting your company in the event of a claim or judgment against you by a visitor.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Get in touch with State Farm agent Janis Mosley's team today to get started.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Janis Mosley

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".